For many individuals, a vehicle is one of the most significant investments they’ll make, second only to purchasing a home. Given the critical role vehicles play in our daily lives, ensuring their longevity and optimal performance is paramount. An auto protection plan, often known as an extended warranty or vehicle service contract, can provide a safety net for car owners. Let’s delve into the manifold benefits of such plans.

1. Financial Security

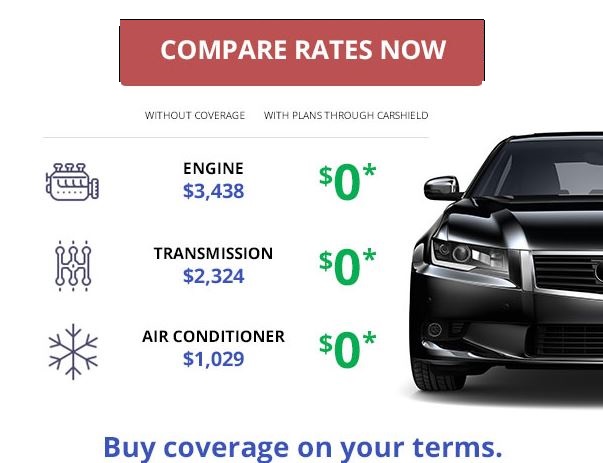

- Unexpected Repairs: Vehicles, like any mechanical entities, can experience unexpected breakdowns. The costs associated with major repairs can be substantial. An auto protection plan can cover these expenses, ensuring you’re not caught off guard by hefty repair bills.

- Budgeting: Knowing that many potential repair costs are covered allows for better financial planning and budgeting. A fixed monthly or annual fee replaces unpredictable out-of-pocket expenses.

2. Comprehensive Coverage

- Broad Spectrum: Many auto protection plans offer comprehensive coverage, spanning from major engine and transmission repairs to electrical system malfunctions.

- Flexibility: Depending on the provider and the plan chosen, you can select from basic to bumper-to-bumper coverage, allowing you to tailor the protection to your needs and budget.

3. Enhanced Resale Value

- Maintenance Record: Vehicles under protection plans often receive timely and professional maintenance, leading to a well-maintained record that can boost resale value.

- Transferability: Some auto protection plans are transferable to the next owner, making the vehicle more attractive to potential buyers.

4. Supplementary Benefits

- Roadside Assistance: Many plans include 24/7 roadside assistance, ensuring help is at hand in case of emergencies like flat tires, dead batteries, or lockouts.

- Rental Car Coverage: While your vehicle is being repaired, the plan may cover the cost of a rental car, ensuring your life isn’t disrupted.

- Trip Interruption: If your car breaks down while you’re away from home, some plans may cover lodging and food expenses.

5. Peace of Mind

- Reduced Stress: There’s an undeniable comfort in knowing that unexpected vehicle issues won’t lead to financial strain.

- Focus on Safety: With a protection plan, vehicle owners are more likely to address issues promptly, ensuring the car remains safe to operate.

6. Expertise and Convenience

- Professional Repairs: Authorized repair centers ensure that your vehicle is in the hands of trained professionals.

- Simplified Processes: Claims procedures are often straightforward, with direct billing between the repair center and the warranty provider, minimizing paperwork for the vehicle owner.

7. Protection Against Inflation

- Locked-in Costs: By securing an auto protection plan, you’re essentially locking in the cost of future repairs, safeguarding against inflation or rising parts and labor costs.

8. Customized Options for Modern Needs

- Electronics Coverage: As modern vehicles become more technologically advanced, repairs aren’t limited to just mechanical parts. Many plans now offer coverage for sophisticated electronics and sensors.

Potential Downsides of an Auto Protection Plan

While auto protection plans offer numerous benefits, they aren’t without drawbacks. Before investing in one, it’s crucial to weigh both the advantages and potential downsides to make an informed decision. Here are some potential cons to consider:

1. Cost vs. Benefit

- Initial Outlay: These plans come with a cost, which might be significant depending on the coverage level. For some, the upfront or ongoing expense might outweigh potential future savings.

2. Coverage Limitations

Wear and Tear: Many plans don’t cover standard wear and tear or maintenance needs, such as brake pad replacements or oil changes.

3. Repair Restrictions

- Authorized Centers: Some plans may require you to visit authorized repair centers or dealerships, limiting your flexibility to choose where your vehicle is serviced.

4. Contractual Fine Print

- Misunderstandings: If not read carefully, the fine print in the contract might lead to misunderstandings about what’s covered and what’s not.

5. Potential for Overlaps

- Manufacturer’s Warranty: If your vehicle is still under the manufacturer’s warranty, an extended protection plan might offer redundant coverage, leading to unnecessary expenses.

Conclusion

An auto protection plan offers a robust safety net for vehicle owners, blending financial security with peace of mind. While there’s an associated cost, the myriad benefits, from comprehensive coverage to enhanced resale value, make it a worthy consideration for many. As with any contract, it’s essential to read the terms, understand the coverage, and choose a plan that aligns with your vehicle’s age, your driving habits, and your financial preferences.